Regulatory Requirements and Compliance

As regulatory requirements become more complex, businesses face increasing challenges in maintaining compliance. Traditional compliance methods are often reactive and resource-intensive, leading to inefficiencies and heightened risks. Enter Artificial Intelligence (AI) and Machine Learning (ML)—technologies that are transforming Regulatory Technology (RegTech) by enhancing fraud detection, transaction monitoring, and risk assessments.

AI-Powered Fraud Detection

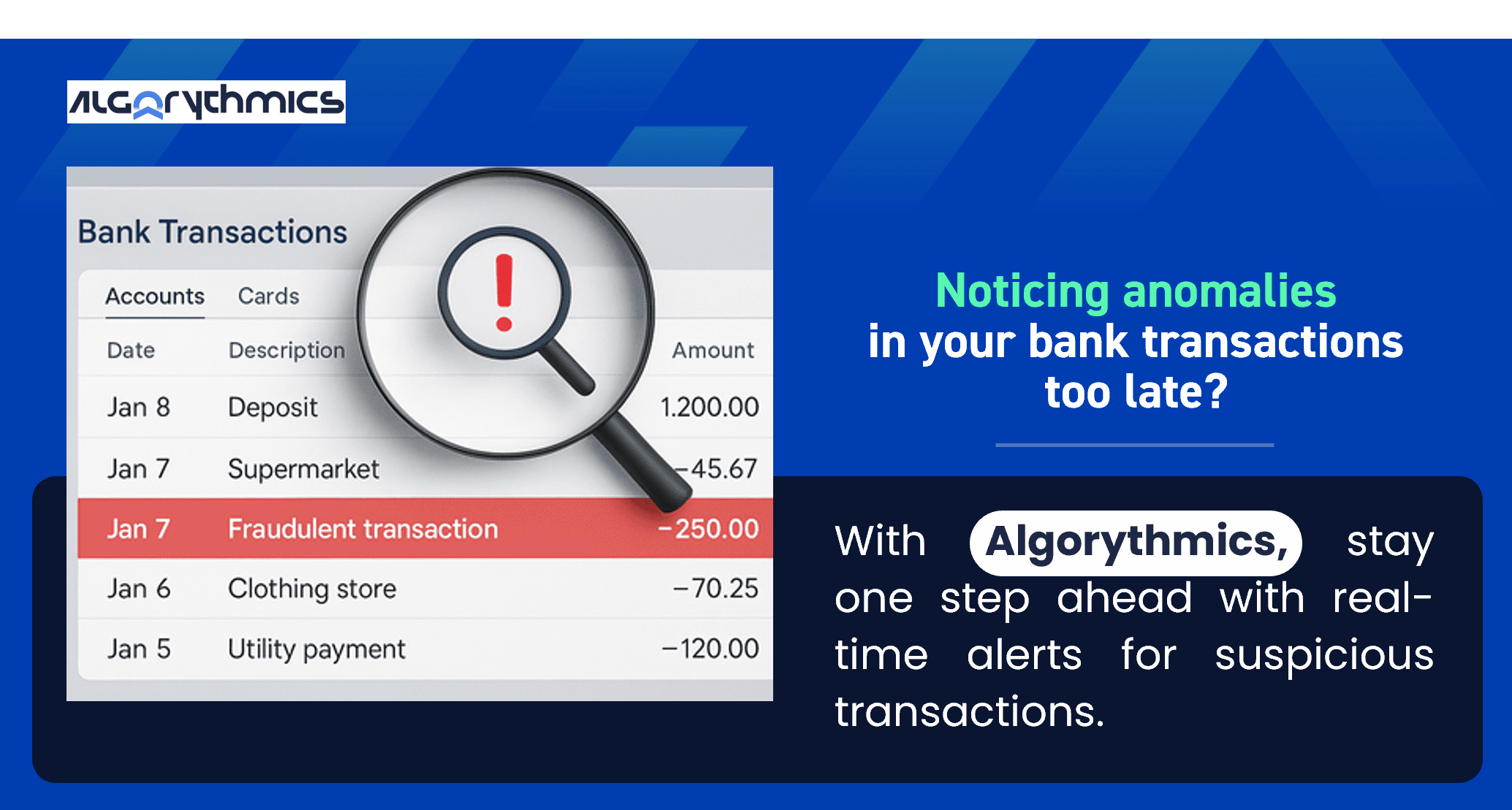

Fraudulent activities are becoming more sophisticated, making it harder for rule-based systems to detect anomalies. AI-powered fraud detection uses pattern recognition and anomaly detection to identify suspicious transactions in real-time. How does it work?

- Behavioral Analysis: AI studies transaction patterns and flags deviations from a user’s usual activity.

- Predictive Analytics: ML models learn from past fraud cases to detect emerging threats.

- Automated Alerts: AI triggers immediate notifications when high-risk activities occur, reducing manual review times.

Real-Time Transaction Monitoring

Traditional transaction monitoring systems rely on static rule sets, which can lead to false positives and compliance bottlenecks. AI-driven solutions, however, adapt dynamically to evolving risks.

- Dynamic Risk Scoring: AI continuously assesses customer profiles and adjusts risk scores based on real-time activities.

- Automated Investigation Workflows: Machine learning algorithms can prioritize alerts, allowing compliance teams to focus on high-risk cases.

- Cross-Border Monitoring: AI enhances visibility into international transactions, ensuring compliance with global AML and KYC regulations.

AI in Risk Assessments and Regulatory Compliance

Regulatory compliance is no longer just about checking boxes; it requires a proactive approach to risk management, says The Financial Brand. AI-driven risk assessments can provide deeper insights into potential regulatory breaches by:

- Identifying Emerging Risks: AI scans multiple data sources, including market trends and regulatory updates, to predict compliance risks.

- Continuous Compliance Audits: ML automates compliance checks, reducing manual oversight.

- Regulatory Reporting Automation: AI streamlines reporting, ensuring accurate submissions to regulators with minimal human intervention.

How Smart is Your RegTech?

Companies in Mauritius’ financial sector and beyond must adopt AI-driven RegTech solutions to stay ahead of compliance challenges. Algorythmics, Mauritius’ first RegTech platform, integrates AI and ML into its compliance solutions to provide:

- Advanced Fraud Detection Tools to minimize financial crimes.

- Real-Time Compliance Monitoring to prevent regulatory breaches.

- Seamless Integration with Financial Systems for end-to-end compliance automation.

By leveraging AI-powered RegTech, businesses can enhance efficiency, reduce costs, and ensure regulatory compliance with minimal disruptions.

Is your compliance strategy future-ready? Contact Algorythmics today to integrate AI and Machine Learning into your compliance framework.