Sanctions and PEP Screening in Mauritius: Why It Matters

In today’s global financial landscape, Sanctions and Politically Exposed Persons (PEP) Screening are essential tools for protecting institutions from financial crime, regulatory breaches, and reputational harm. As regulators tighten their scrutiny, especially in jurisdictions like Mauritius, robust screening practices have become a non-negotiable aspect of compliance for financial institutions and Designated Non-Financial Businesses and Professions (DNFBPs).

Mauritius, as an international financial centre, has adopted strict rules to ensure local compliance aligns with global standards.

The Legal Framework in Mauritius

The Financial Intelligence and Anti-Money Laundering Act (FIAMLA) 2002 sets out clear obligations:

- PEP Screening falls under Section 18, supported by the FSC Handbook 2021 and the Bank of Mauritius AML/CFT Guidance Notes.

- Sanctions Screening is mandated by Section 30H of FIAMLA and reinforced by the UN Sanctions Act 2019, with practical enforcement through FIU directives.

This dual framework requires institutions not only to know their customers but also to actively monitor them against high-risk profiles and sanctioned lists.

Understanding Sanctions and PEP Screening

Sanctions Screening means checking clients, entities, and transactions against global watchlists such as the UN, OFAC, EU, or UK lists. The aim is simple: stop business with prohibited individuals or organisations involved in terrorism, arms proliferation, or other high-risk activities.

PEP Screening, by contrast, focuses on individuals who hold or have held prominent public positions — such as ministers, judges, military leaders, or executives of state-owned enterprises. Because of their influence, PEPs (along with their close associates and relatives) present a higher risk of corruption or abuse of power.

Why Effective Screening Is Essential

The importance of screening cannot be overstated. Missing a link to a sanctioned person can result in severe legal and financial penalties, frozen transactions, or reputational fallout that may take years to repair. Similarly, dealing with a PEP without enhanced due diligence can expose an institution to corruption-related scandals, regulatory breaches, and loss of trust.

For institutions in Mauritius, sanctions and PEP screening are not just compliance obligations — they are risk management tools that protect the integrity of the financial system.

How Algorythmics Supports Compliance

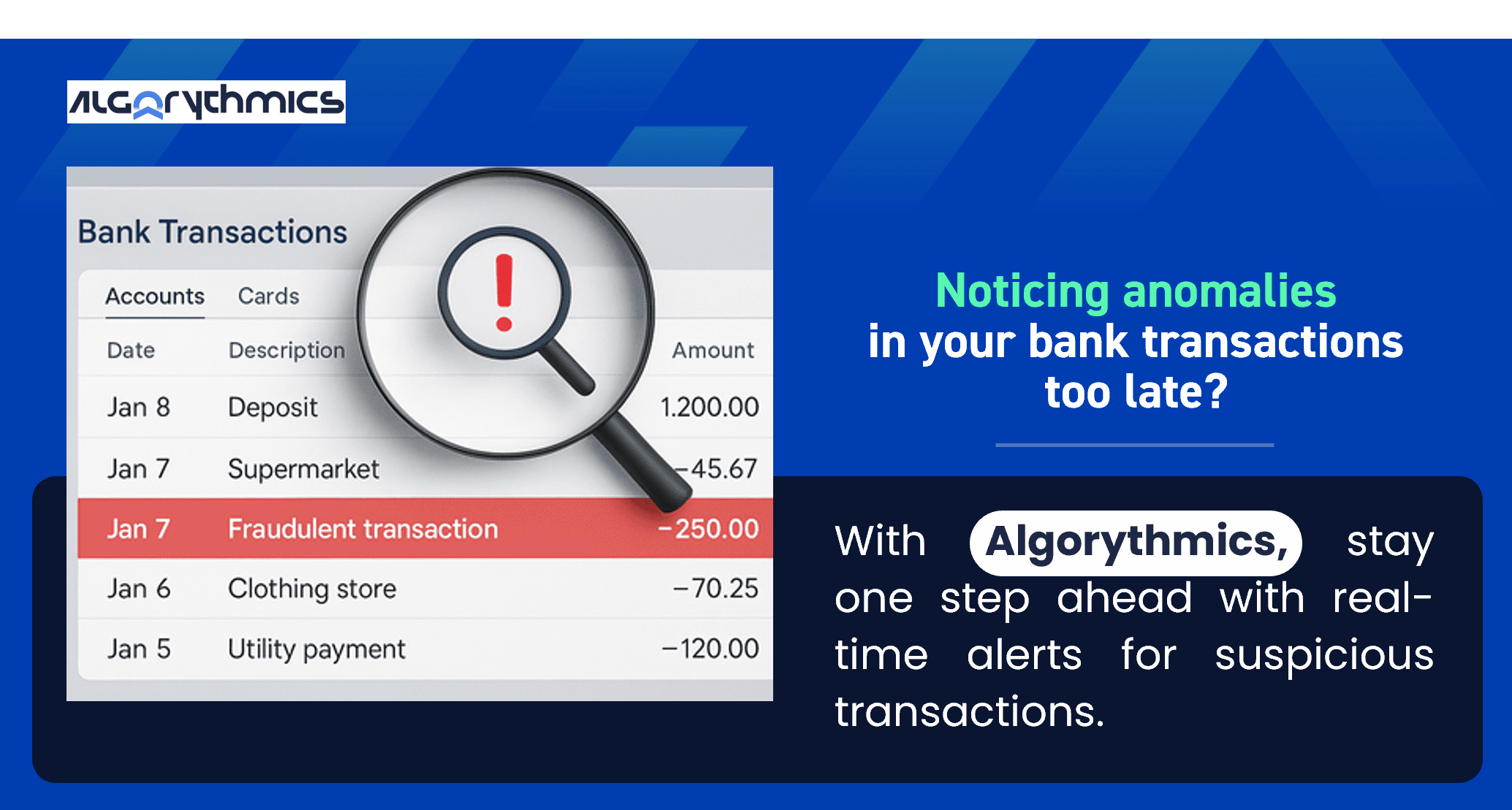

At Algorythmics, we help institutions simplify complex compliance requirements. Our RegTech solutions provide:

- Automated sanctions and PEP screening against trusted global databases

- Customisable risk scoring to fit your institution’s profile

- Real-time alerts and monitoring for faster response

- Audit-ready reporting to streamline regulatory inspections

With data science, AI, and machine learning at our core, Algorythmics enables institutions to stay ahead of regulatory changes, reduce compliance costs, and focus on core business growth.

Final Thoughts

Sanctions and PEP screening are more than regulatory checklists. They are vital mechanisms for protecting financial integrity, mitigating risk, and preserving reputation in a high-stakes global environment. Mauritius has put in place strong legislation, but it is up to institutions to ensure these frameworks are implemented effectively.

With Algorythmics, organisations can embrace compliance not as a burden, but as a strategic advantage.

Contact us today at [email protected] to learn how our screening solutions can strengthen your compliance journey.

About the Collaboration

This initiative is the result of a close collaboration between Algorythmics and NFS Group Global Ltd.