The Rise of RegTech in Mauritius: Smarter Compliance for Modern Businesses

In recent years, Mauritius has positioned itself as a trusted international financial centre, built on transparency, governance, and compliance. Yet, as global and local regulations become more stringent — from AML/CFT and FATCA/CRS to data protection and e-Invoicing — businesses face an increasing burden to keep up.

Compliance has evolved from a back-office requirement to a strategic business function, essential to maintaining credibility and competitiveness. This is where RegTech (Regulatory Technology) steps in — and where Algorythmics leads the charge in Mauritius.

From Manual Compliance to Intelligent Automation

Traditional compliance processes often depend on manual reporting, fragmented data, and human intervention — all prone to delays and errors. In a fast-changing regulatory environment, such methods can expose businesses to operational risks and penalties.

RegTech transforms this reality by combining automation, artificial intelligence (AI), and data analytics to make compliance faster, smarter, and more efficient.

Through its unified RegTech platform, Algorythmics enables organizations to:

-

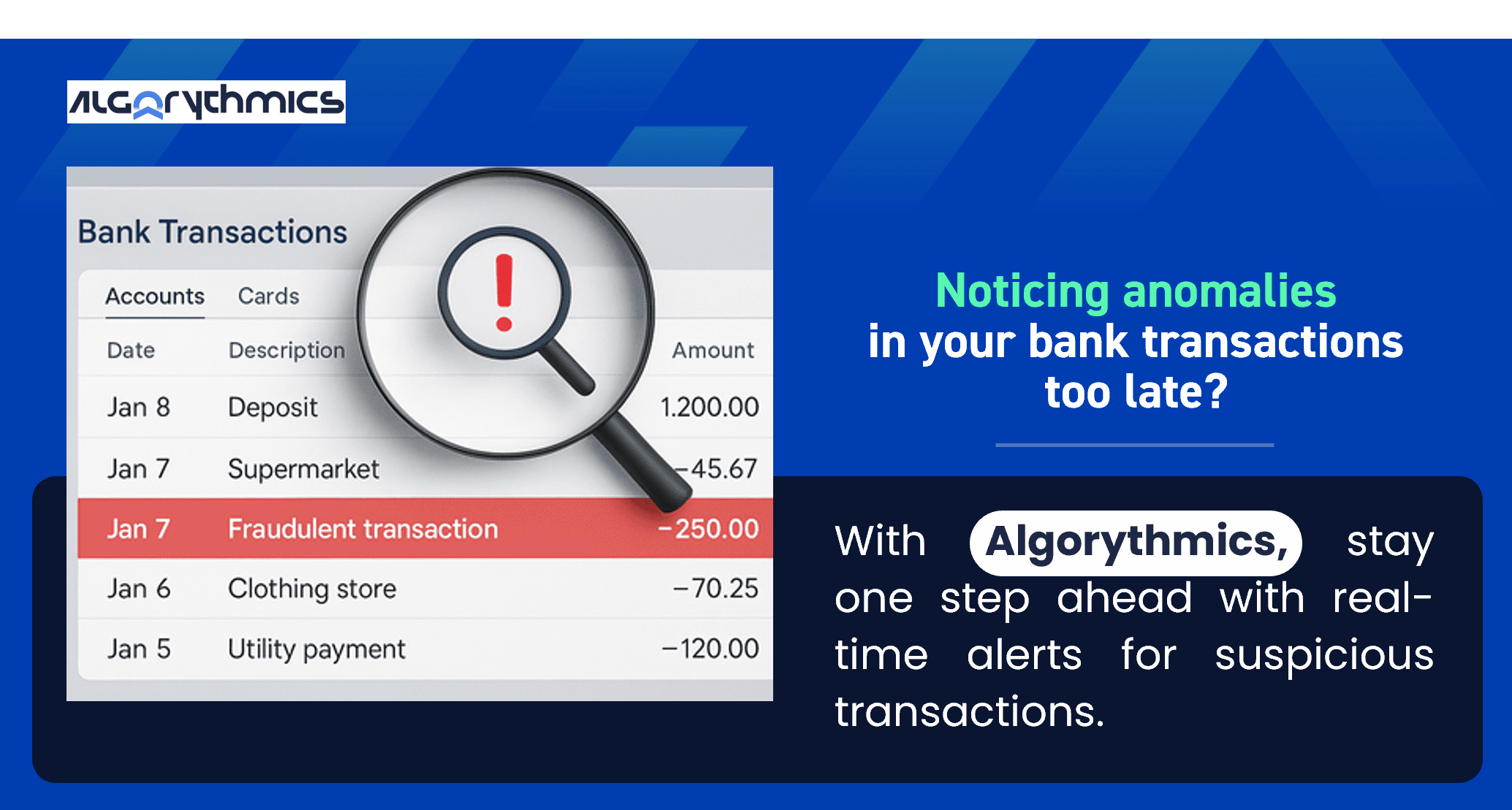

Monitor transactions in real time with Transaction Monitoring.

-

Streamline customer verification with e-KYC and biometric validation tools.

-

Simplify regulatory reporting with FATCA/CRS Compliance modules.

-

Automate repetitive financial tasks such as Update of Currency Exchange Rates.

Together, these solutions empower businesses to stay audit-ready, reduce errors, and maintain continuous compliance — without adding administrative strain.

Why RegTech Is a Competitive Advantage

Compliance used to be seen as a cost centre. Today, it’s a driver of trust and growth.

By adopting RegTech, Mauritian organizations benefit from:

-

Efficiency Gains – Automation reduces time spent on manual reviews and reporting.

-

Enhanced Accuracy – AI algorithms detect anomalies early, preventing fraud and human error.

-

Cost Reduction – Streamlined workflows lower operational costs while improving control.

-

Audit Readiness – Every action is logged, traceable, and compliant with local and international standards.

For regulated industries such as banking, insurance, and corporate services, this digital transformation is not just an upgrade — it’s a safeguard for the future.

Mauritius Embracing Digital Governance

Mauritius’s regulators and institutions — including the Financial Services Commission (FSC), the Mauritius Revenue Authority (MRA), and the Economic Development Board (EDB) — are actively encouraging digital adoption and automation.

This progressive environment creates fertile ground for RegTech innovation, aligning local businesses with international best practices in risk management, governance, and transparency.

By implementing platforms like Algorythmics, Mauritian enterprises not only meet compliance standards — they contribute to building a smart, data-driven, and trustworthy economy.

The Algorythmics Difference

Developed by Cybernaptics, Algorythmics brings together cutting-edge technology and local expertise to help organizations turn compliance into a competitive edge.

Its RegTech ecosystem is designed for the Mauritian context — compliant with local laws, adaptable to evolving frameworks, and scalable across sectors.

Whether it’s automating back-office workflows or leveraging AI for risk scoring, Algorythmics ensures that compliance becomes a source of efficiency, not complexity.

Conclusion

The future of compliance in Mauritius is automated, intelligent, and proactive.

By adopting RegTech solutions like Algorythmics, organizations can move beyond regulatory survival — toward operational excellence and digital leadership.