In the ever-evolving realm of financial services, regulatory compliance has transcended its conventional role as a mere obligation. It has assumed the pivotal position of a driving force, shaping the trajectory of businesses. Mauritius, with its increasing financial sector, is no exception to this paradigm shift. Today, we delve into the pressing industry challenges of navigating this complex compliance landscape.

Mounting Compliance Significance

Once referred to as a checkbox on an operational to-do list, compliance has emerged as a paramount consideration for businesses. The evolving regulatory landscape demands meticulous attention, not merely for adherence but as a critical factor for sustainable operations. With global standards continuously evolving, businesses must adapt to stay ahead.

Labour Scarcity

Finding and retaining skilled compliance professionals is no longer a straightforward task. The industry faces a scarcity of experts well-versed in the nuances of regulatory compliance. This scarcity amplifies the compliance burden, placing a premium on organizations that can secure and retain these valuable resources.

Intriguingly, as we analyze the workforce landscape, a trend dating back to 1970 becomes evident. Statistics Mauritius reports a decline in primary school enrolment over the years, a trend that has persisted through 2022. This decline in primary school enrolment figures underscores the changing dynamics of the education system and the challenges it poses for future workforce development.

Escalating Workload Pressure

The volume and complexity of compliance tasks have skyrocketed. From Anti-Money Laundering (AML) to Electronic Know Your Customer (EKYC), businesses contend with a barrage of regulatory requirements. This surge in workload places a substantial strain on operational teams. Efficient processes and automation are essential for navigating this challenging terrain.

Rising Operational Costs

Compliance is not cost-free. Fulfilling regulatory requirements involves financial commitments that encompass technology, staff training, and resources. Staying ahead in the compliance game necessitates a strategic approach to manage and optimize these operational costs.

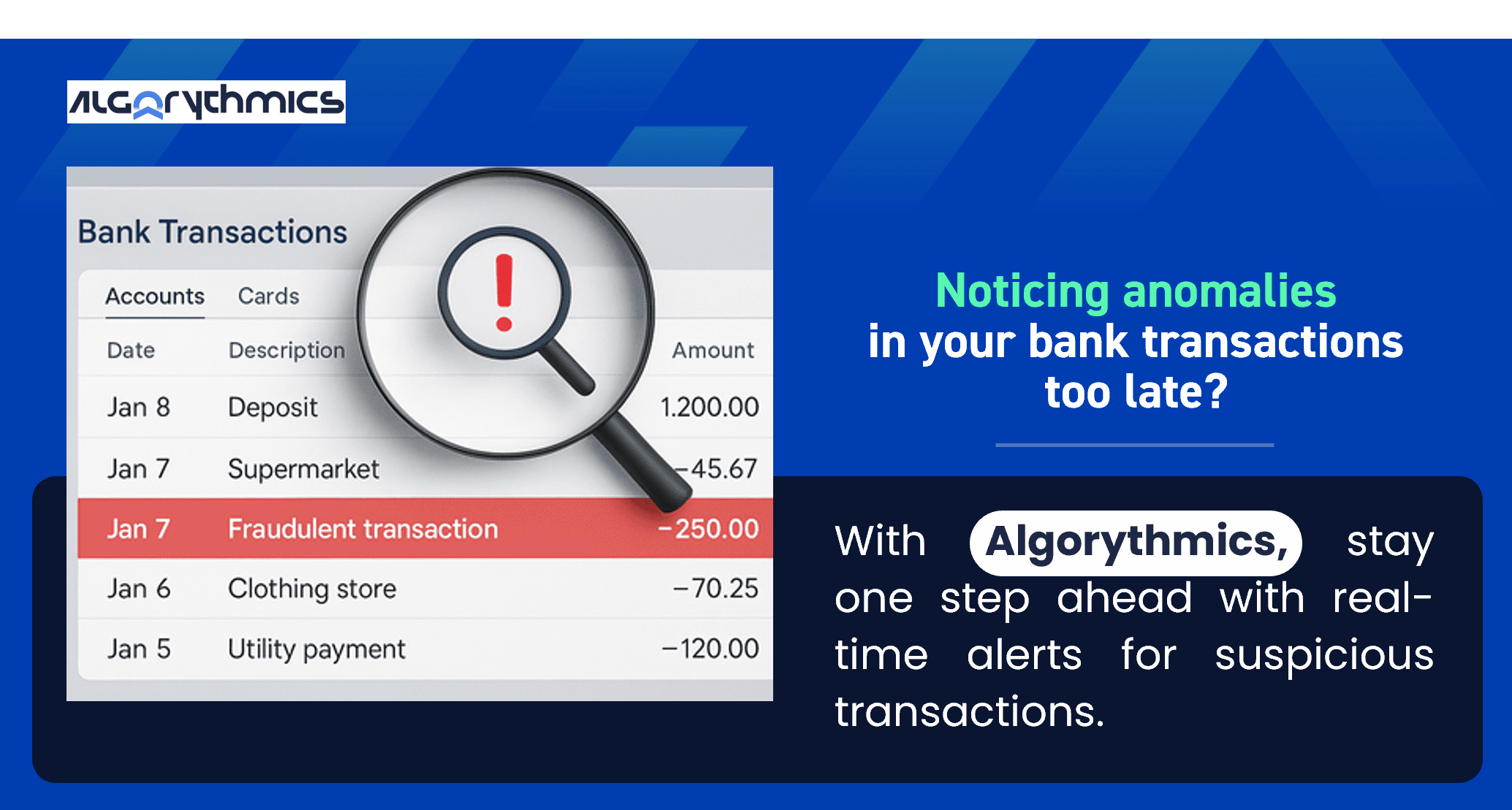

The Role of RegTech

As the compliance landscape grows more intricate, RegTech solutions like Algorythmics offer a lifeline. These technologies leverage automation, data analytics, and AI to streamline compliance processes. In Mauritius, where compliance is integral to the financial sector’s growth, RegTech has become indispensable.

In conclusion, the compliance landscape in Mauritius is undergoing a transformative shift. Regulatory compliance is no longer a box to tick but a strategic imperative. The challenges posed by this shift are significant, but with the right tools and strategies, businesses can navigate the compliance landscape successfully.

Stay tuned for more insights on how Algorythmics is reshaping compliance in Mauritius, leveraging the power of RegTech to overcome these challenges.