AI in Compliance: When Technology Anticipates Risk

In a world where regulatory frameworks evolve faster than ever, businesses can no longer rely on manual processes to ensure compliance. Artificial intelligence (AI) and machine learning (ML) are transforming the way organizations identify risks, detect fraud, and make informed decisions.

At the forefront of this transformation in Mauritius is Algorythmics — a RegTech platform by Cybernaptics that uses intelligent automation to help companies stay compliant while improving efficiency.

From Reactive to Proactive Compliance

Traditional compliance models often rely on after-the-fact reviews. AI changes that.

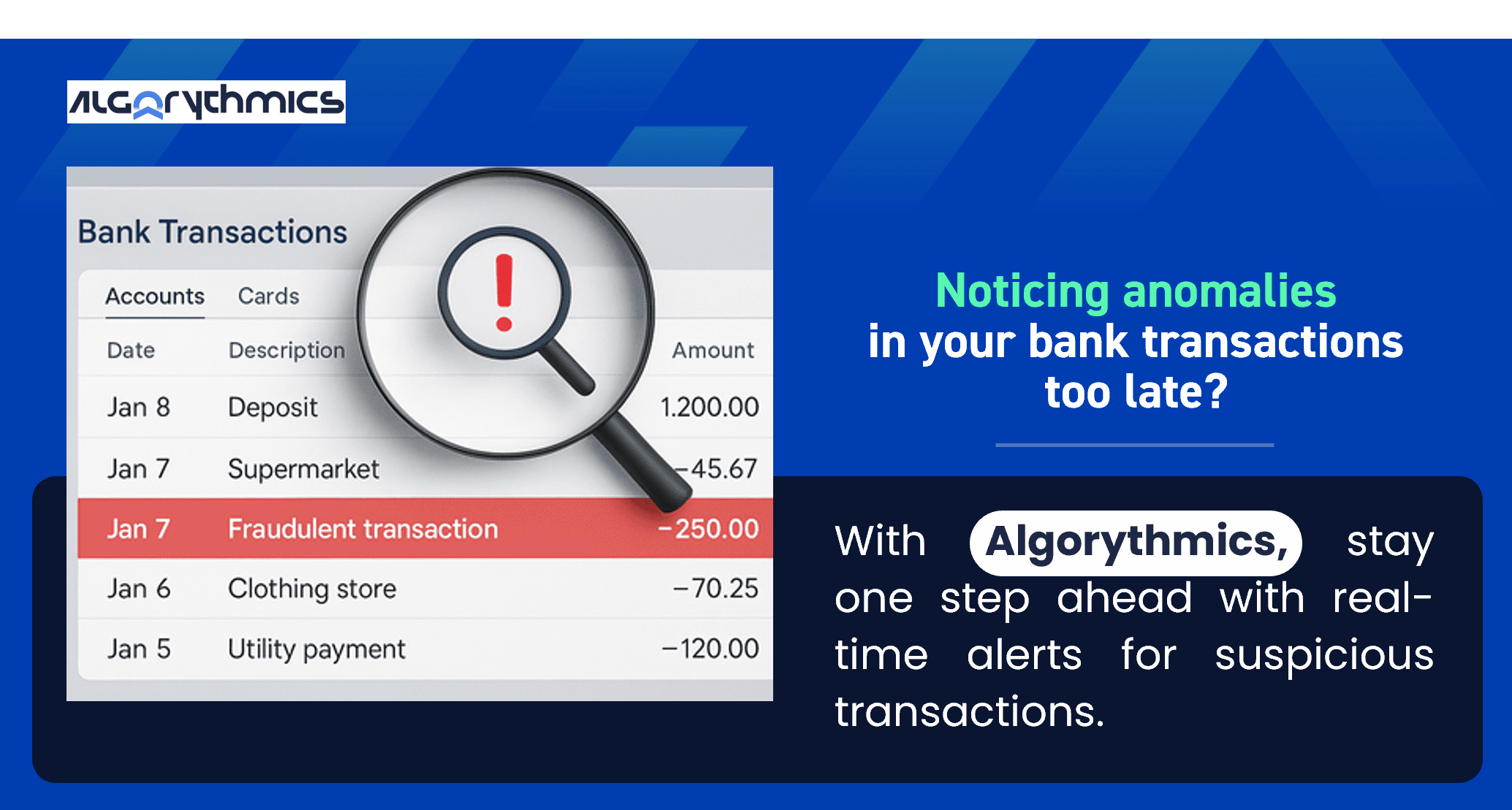

By continuously analyzing transactional data, AI systems can detect anomalies in real time, flagging suspicious behaviors long before they become compliance breaches.

Through its Transaction Monitoring module, Algorythmics leverages machine learning to identify patterns of fraud or money laundering, helping financial institutions and corporates prevent risks rather than just respond to them.

Smarter Decision-Making with Data Science

Beyond automation, Algorythmics brings data-driven intelligence to compliance.

By combining machine learning algorithms with domain expertise, the platform provides accurate insights that support regulatory reporting, audit trails, and strategic decision-making.

This means compliance teams spend less time on manual data review — and more time on what truly matters: interpreting insights and improving governance.

Reducing False Positives, Enhancing Efficiency

AI’s biggest strength lies in its ability to learn. Over time, Algorythmics’ models improve accuracy, reducing false positives and minimizing unnecessary investigations. This ensures compliance officers can focus their efforts on genuine risks while streamlining operations.

A Trusted RegTech Partner in Mauritius

Mauritian companies are facing growing expectations from local and international regulators such as the Financial Services Commission (FSC).

Algorythmics helps them meet these standards with scalable, automated, and audit-ready solutions that evolve alongside new regulations — from AML/KYC to FATCA and CRS compliance.

Conclusion: The Future of Compliance is Intelligent

AI is not replacing human judgment — it’s amplifying it.

With solutions like Algorythmics, Mauritian organizations can move from reactive compliance to proactive governance, using technology not just to meet regulations but to anticipate risks and enhance performance.