Strengthening Global Tax Transparency with FATCA & CRS Compliance

Understanding FATCA & CRS Reporting In today’s interconnected financial world, transparency is non-negotiable. Two key frameworks — FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) — play a vital role in promoting global tax compliance. Both frameworks have been adopted in Mauritius, a member of the OECD’s Global Forum on Transparency and […]

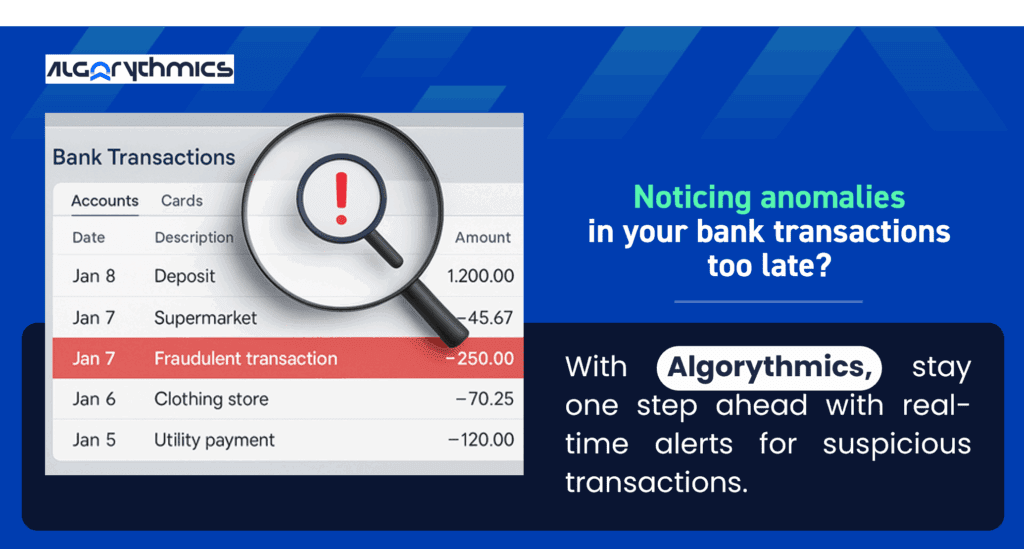

Transforming Compliance with Technology-Driven Transaction Monitoring

Why Transaction Monitoring Matters Transaction monitoring is a cornerstone of Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) compliance. For financial institutions, the ability to detect and respond to suspicious activity is not only a regulatory requirement but also essential for safeguarding reputation and trust. In Mauritius, compliance is guided by the Financial Intelligence […]

Sanctions and PEP Screening in Mauritius

Sanctions and PEP Screening in Mauritius: Why It Matters In today’s global financial landscape, Sanctions and Politically Exposed Persons (PEP) Screening are essential tools for protecting institutions from financial crime, regulatory breaches, and reputational harm. As regulators tighten their scrutiny, especially in jurisdictions like Mauritius, robust screening practices have become a non-negotiable aspect of compliance […]

E-KYC in Mauritius: A Digital Transformation in Customer Onboarding

E-KYC in the Mauritian Context In an increasingly digital world, businesses across industries are rethinking how they onboard customers. The traditional paper based Know Your Customer (KYC) process is time-consuming, costly, and prone to errors. That’s where Electronic Know Your Customer (E-KYC) comes in—offering a faster, safer, and more efficient way to verify identity and […]

CRA & BRA: Turning Risk Into Readiness

Turning Risk Into Readiness: Why CRA & BRA Are More Than Just Compliance Tools As financial crime grows more sophisticated and regulatory expectations intensify, the old model of static policies and checklists no longer cuts it. In today’s regulatory climate — shaped by the Financial Action Task Force (FATF) and its risk-based approach to AML/FT […]

Algorythmics : Plateforme RegTech mauricienne qui automatise la conformité grâce à l’intelligence artificielle

Algorythmics : La conformité intelligente et automatisée Face à un environnement réglementaire en constante mutation, les entreprises mauriciennes doivent conjuguer conformité et performance. Algorythmics, la première plateforme RegTech lancée par Cybernaptics à Maurice, apporte une réponse intelligente et automatisée à ces défis. Grâce à l’intelligence artificielle, au machine learning et à la data science, la […]

FATCA & CRS Compliance in Mauritius

Understanding FATCA in the Mauritian Context The Foreign Account Tax Compliance Act (FATCA) is a U.S. federal law aimed at preventing tax evasion by U.S. taxpayers holding accounts and financial assets outside the United States. Mauritius has embraced FATCA by signing an intergovernmental agreement (IGA) with the U.S. on December 27, 2013, facilitating the implementation […]

AI and Machine Learning in Compliance: How Smart is Your RegTech?

Regulatory Requirements and Compliance As regulatory requirements become more complex, businesses face increasing challenges in maintaining compliance. Traditional compliance methods are often reactive and resource-intensive, leading to inefficiencies and heightened risks. Enter Artificial Intelligence (AI) and Machine Learning (ML)—technologies that are transforming Regulatory Technology (RegTech) by enhancing fraud detection, transaction monitoring, and risk assessments. AI-Powered […]

Evolving Compliance in Mauritius: Why RegTech Is Now a Business Necessity

The Rise of RegTech in Mauritius: Smarter Compliance for Modern Businesses In recent years, Mauritius has positioned itself as a trusted international financial centre, built on transparency, governance, and compliance. Yet, as global and local regulations become more stringent — from AML/CFT and FATCA/CRS to data protection and e-Invoicing — businesses face an increasing burden […]

Back Office Automation in Mauritius: Real-Time Currency Updates with Algorythmics

Back Office Automation in Mauritius: Real-Time Currency Updates with Algorythmics In Mauritius’s fast-moving business landscape, companies are under growing pressure to modernize their financial operations. Between regulatory obligations, exchange rate fluctuations, and the need for transparent reporting, manual processes can no longer keep up. That’s where back office automation makes a difference. By using technology […]